Remote hiring in the Philippines is a great opportunity to access skilled and cost-effective talent, but navigating local labour laws, government registrations, and mandatory benefits can be challenging.

For foreign companies or businesses without a local entity, managing DOLE (Department of Labor and Employment) compliance, payroll, and statutory contributions can quickly become complex and time-consuming.

For instance, a recent high-profile case illustrates just how risky things can get: Joanna Pascua, a Filipino paralegal working remotely for an Australian firm, was classified on paper as an independent contractor. However, the Fair Work Commission ruled that she was in fact an employee, entitling her to Australian workplace protections.

This landmark ruling is a wake-up call for businesses that hire offshore workers, especially in Australia: misclassifying remote staff can lead to serious legal and financial exposure. That is where an Employer of Record (EOR Philippines) becomes not just useful, but essential — helping you structure remote employment, stay compliant, and protect your company as you reap all the benefits of offshoring.

What Is an Employer of Record (EOR)?

An Employer of Record (EOR) is a service provider that legally employs workers on behalf of your company.

While your business supervises the employee’s daily tasks, the EOR takes care of all employment-related responsibilities, including contracts, payroll, benefits, and regulatory compliance.

For companies hiring in the Philippines without a local legal entity, an EOR ensures full compliance with local labour laws and government requirements while reducing administrative burdens.

How Does an EOR Work in the Philippines?

An employer of record in the Philippines acts as the official employer and ensures adherence to all labour regulations.

Here’s what that involves:

- Legal Employment and Government Registration

The EOR signs the employment contract and handles registrations with all regulatory bodies:

- DOLE (Department of Labor and Employment)

- SSS (Social Security System)

- PhilHealth

- Pag-IBIG Fund

- BIR (Bureau of Internal Revenue)

This ensures your employees are fully recognized and protected under Philippine law.

- Payroll and Mandatory Benefits

The employer of record in the Philippines manages:

- 13th-month pay (required for all employees)

- Overtime pay, night differential, and holiday pay

- Leave benefits, including service incentive leave

- Statutory contributions to government agencies

- Tax withholding and reporting

This protects your business from penalties for non-compliance.

- HR Compliance and Risk Management

The EOR ensures:

- Proper employee classification

- DOLE-compliant contracts and termination procedures

- Handling employee grievances or disputes

- Safe and legal working conditions

You maintain control over tasks, work hours, and performance, while the EOR handles the legal and administrative side.

Why Choose an EOR When Hiring in the Philippines?

When hiring in the Philippines, businesses often weigh different models: independent contractors, local direct hires, or through an employer of record.

Each option has advantages and risks, especially around compliance, payroll, and labour law obligations:

EOR vs. Contractor Model vs. Local Direct Hire

| Feature | EOR Model | Contractor Model | Local Direct Hire |

| Setup Time | Hire within days; no local entity required | Immediate; no legal setup needed | Weeks to months to establish a local entity in the PH |

| Legal Employer | EOR is the legal employer | You are technically a client, not the employer | Your company is the legal employer |

| Payroll & HR | EOR manages payroll, taxes, and benefits | Client pays the agreed fees, but because the contractor handles their own taxes, misclassification or errors can create compliance risks. | Company manages payroll, statutory contributions, and HR in-house |

| Compliance | Fully DOLE- and BIR-compliant | Risk of misclassification; limited protections | Full compliance required; company responsible for all of it |

| Benefits Paid | 13th-month pay, SSS, PhilHealth, Pag-IBIG | No statutory benefits, only contractually agreed perks | 13th-month pay, SSS, PhilHealth, Pag-IBIG, leave, other statutory benefits |

| Costs | Lower upfront and operational costs | Often lower initially, but with significant risk of fines or legal costs | Higher costs due to HR staff, legal support, and local office |

| Flexibility | Easy to scale team up or down | Flexible; but limited control and high legal risk | Less flexible; tied to local entity and contracts |

| Risk | Low legal risk | High legal and financial risk if misclassified | Moderate risk; compliance errors possible without proper HR support |

Summary: Choosing employer of record services in the Philippines allows businesses to hire quickly, stay fully compliant with Philippine labor regulations, and reduce operational burden.

Contractors carry high legal and compliance risks in Australia, while local direct hires require a more involved setup for HR and administrative resources.

Legal & Tax Compliance Considerations

When hiring in the Philippines, compliance with labour and tax laws is critical. Let’s dive deeper into how each hiring model handles these obligations:

| Feature | EOR Model | Contractor Model | Local Direct Hire |

| DOLE Compliance | Fully compliant; EOR ensures contracts and labour standards | Limited; high risk of misclassification | Company must ensure full compliance |

| Tax Withholding & Reporting | Managed by EOR | Often not handled; client may be liable | Company manages all BIR reporting and withholding |

| Government Contributions | SSS, PhilHealth, Pag-IBIG fully managed | Not provided | Company must manage in-house |

| 13th-Month Pay | Included and managed | Not provided | Company responsible |

| Risk of Penalties | Low | High | Moderate; depends on HR/finance accuracy |

Summary: An EOR ensures full compliance with labour laws, taxes, and statutory contributions (SSS, PhilHealth, and Pag-IBIG contributions), and 13th month pay in the Philippines, reducing the risk of fines, penalties, or legal disputes.

Contractors are high-risk due to misclassification, while local direct hires require dedicated HR and legal management to stay compliant.

Philippines EOR vs. PEO

In addition to comparing contractors and local direct hires, businesses may also encounter Professional Employer Organizations (PEOs) when hiring in the Philippines.

How are they different?

While PEOs and EORs sound similar, there are key differences that affect compliance, legal responsibility, and flexibility.

An employer of record acts as the sole legal employer of your team. The EOR handles all payroll, benefits, statutory contributions, and labour law compliance.

This makes it ideal for companies that want to hire in the Philippines without a legal entity while minimizing legal and administrative risk.

Your business continues to manage day-to-day tasks and employee performance, while the EOR takes care of all employment matters related to regulatory and legal compliance.

A PEO, by contrast, operates through a co-employment arrangement. The client company and the PEO share certain legal responsibilities.

While the PEO manages payroll, benefits, and HR administration, the client usually still needs a local legal entity and retains partial responsibility for compliance.

Because of this co-employment setup, the client still needs to establish a presence in the Philippines, such as a registered business or legal entity, to handle part of the legal obligations.

This setup works well for companies that already have a local entity and want HR support while maintaining some legal control.

In short, if your goal is fast, compliant hiring without setting up a local entity, an EOR Philippines is typically the safer and more flexible option.

A PEO is better suited for businesses that already have a local entity and want to outsource HR functions while keeping some legal oversight and authority.

Key Services Included in EOR Philippines Solutions

An EOR handles the most time-consuming HR and compliance tasks so foreign employers can focus on operations.

Payroll and Tax Filing Made Simple

An EOR handles all payroll processing, salary disbursements, tax withholding, and BIR reporting on your behalf.

By using this payroll outsourcing in the Philippines, foreign employers no longer need to navigate complex PH tax rules, submit monthly filings, or worry about penalties for incorrect remittances.

Plus, the EOR ensures accurate, on-time payroll every cycle.

Streamlined Onboarding and Locally Compliant Contracts

The EOR prepares DOLE-compliant employment contracts, manages onboarding documents, and ensures employees are properly registered before work begins.

This simplifies onboarding employees in the Philippines and removes the need for foreign companies to interpret local labour laws.

Labour Law Compliance and DOLE Registration

From keeping up with labour standards to managing DOLE requirements, the EOR keeps your employment practices compliant.

This includes correct employee classification, lawful termination procedures, proper record-keeping, and adherence to wage, overtime, and holiday pay rules.

Leveraged with the advantages of EOR with Philippine compliance, it ensures your team operates fully within the law.

Administration of Government Benefits (SSS, Pag-IBIG, PhilHealth)

An EOR fully manages all statutory contributions required under Philippine law.

This includes enrollment, monthly payments, and reporting to:

- SSS

- PhilHealth

- Pag-IBIG Fund

For foreign employers, this removes the entire administrative and regulatory burden of learning how these systems work and ensuring employees receive their full benefits.

When Should You Use an EOR in the Philippines?

Using an EOR makes sense whenever you want to hire Philippine talent quickly and legally, while minimising administrative work and legal risk.

It’s particularly useful when you’re:

Expanding Without a Local Entity

If you want to hire employees quickly, an employer of record in the Philippines is the fastest and safest route.

You can onboard staff within days while staying fully compliant with DOLE, BIR, and all statutory requirements, without forming a corporation or navigating complex registration processes.

You can onboard staff within days while ensuring adherence with DOLE, BIR, and full statutory compliance with an EOR in the Philippines.

That’s without even forming a corporation or navigating complex registration processes.

Converting Freelancers to Full-Time Staff

Many businesses start with contractors, but over time may need more stability, control, and legal certainty.

An EOR allows you to convert freelancers into legitimate employees, giving them full protections and benefits while safeguarding your company from misclassification risks.

This ensures seamless compliance while taking advantage of global employment solutions in the Philippines.

Testing a New Market Without Long-Term Commitment

If you’re exploring the Philippines as a potential market, an EOR lets you build a small team, validate demand, and operate locally—all without the cost or obligations of setting up a permanent entity.

It’s a low-risk way to scale up or wind down depending on results.

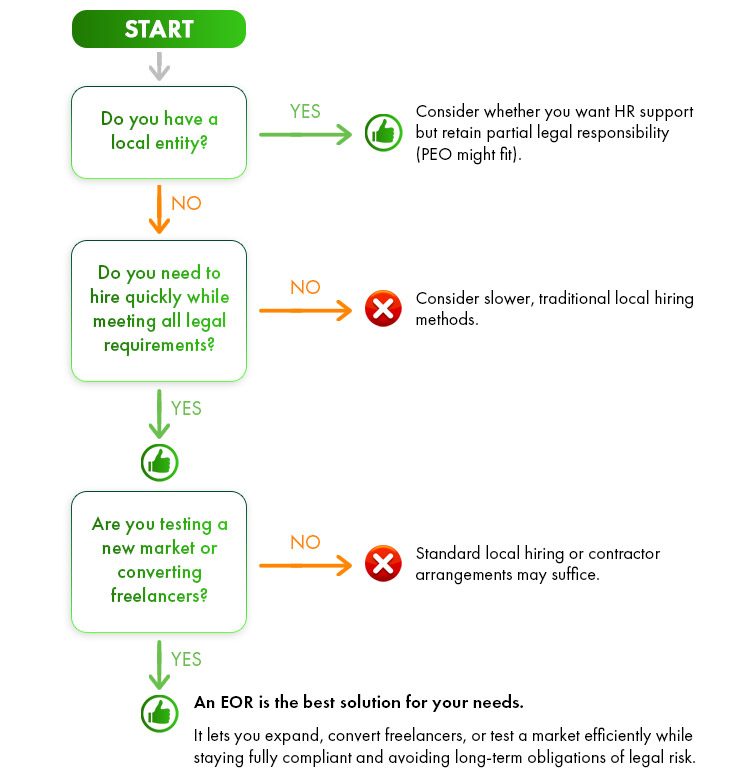

Still not sure if an EOR is the right fit for your team? You can refer to the following flow chart to help you decide:

Remote Staff’s Advantage as Your Philippine-Based EOR

When it comes to hiring in the Philippines, having a local partner with deep knowledge of labour laws, payroll, and HR practices is invaluable.

Remote Staff combines experience, expertise, and a fully local team to make remote hiring seamless and compliant.

17 Years of On-the-Ground Expertise

With nearly two decades operating in the Philippines, Remote Staff understands the nuances of local labour regulations, government registrations, and employee benefits.

This experience ensures your team is onboarded efficiently and correctly the first time.

Specialized in AU & US SMEs

Remote Staff has extensive experience working with small and medium enterprises in Australia and the United States.

We know the expectations of international clients and can tailor solutions to meet your business needs while staying fully compliant with Philippine laws.

Local HR & Legal Compliance Team

Our in-house HR and legal specialists handle all statutory requirements, from DOLE registration and BIR filings to SSS, PhilHealth, and Pag-IBIG contributions.

This means you can focus on business operations and workforce management in the Philippines while we take care of compliance, payroll, and employee administration.

With Remote Staff as your employer of record in the Philippines, you get the confidence of local expertise, ensuring your Philippine-based team is managed legally, efficiently, and professionally.

Frequently Asked Questions (FAQ)

Here are some of the most common questions businesses ask when considering an employer of record in the Philippines.

How much does an EOR cost in the Philippines?

Pricing depends on factors like the number of employees, roles, and level of services required.

Generally, fees cover payroll processing, statutory contributions, compliance management, and HR administration.

What’s the difference between a BPO and an EOR?

A BPO (Business Process Outsourcing) provides outsourced support for specific business functions, such as customer service, accounting, or IT operations, but you don’t have direct control over how their team performs day-to-day tasks.

An EOR, by contrast, legally employs your team, managing payroll, contracts, benefits, and compliance, while you direct their day-to-day work.

Can I convert my contractor into an employee via EOR?

Yes. An EOR can transition freelancers or independent contractors into full-time employees, ensuring they receive proper contracts, statutory benefits, and full compliance under Philippine labour law.

This makes it an ideal solution for international hiring in the Philippines while reducing legal and administrative risks.

Do I need to register a business in the Philippines to hire?

No. One of the main advantages of an EOR is that you can hire legally without forming a local entity.

The EOR serves as the legal employer while you supervise and retain control over your team’s daily tasks.

What does an EOR not cover?

An EOR manages employment, payroll, benefits, and compliance, but does not oversee or evaluate the employee’s daily tasks or deliverables.

You will retain full control over managing your team’s performance, assignments, and operational outcomes.

Start Building Your Philippine Team with Confidence

An EOR lets you hire skilled talent quickly, maintain full statutory compliance, and reduce administrative burdens without setting up a local entity.

With Remote Staff as your partner, you can focus on managing your team and growing your business while we handle payroll, contracts, benefits, and all regulatory compliance – all so you won’t have to.

Take the next step: schedule a call with Remote Staff today!

Leandro is a content creator and digital nomad who started his career as a remote working content writer. He is an advocate of location independent sources of income. And he believes that everyone has the ability to be one as well. If you have any content requests and suggestions, feel free to email him at leandro@remotestaff.com.