Benjamin Franklin wasn’t kidding when he said that only two things are certain in life: death and taxes. It’s true that none of us can escape dying, no matter who we are or what we do. But unlike death, we have to grapple with tax season every year.

Filing taxes can be a headache. If you’re like most people, you probably forget about or even put off doing your taxes. However, delays can result in monetary penalties, legal ramifications, or even jail time in extreme cases.

To avoid these issues, it’s best to file your taxes on time. Thus, knowing the requirements in advance can save you a lot of stress later on. In line with that, the Australian Taxation Office (ATO) just released a tax reminder for millions of Australians.

The timing couldn’t be better, as thousands of Australian workers are already returning to the office this year. However, this poses some tricky tax questions about expenses incurred while working remotely.

So, whether you’re still working from home or have already returned to the office, here are three ways to claim your work from home expenses:

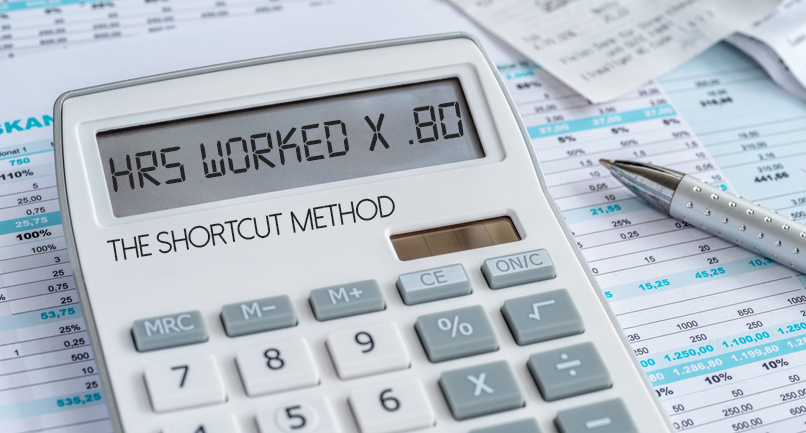

The Shortcut Method

Yes, you read that right. There’s a shortcut method for filing taxes introduced by the ATO. You can use it when you file your taxes on 1 July 2021.

According to Assistant Commissioner Tim Loh, “The shortcut method is straight forward; just multiply the hours worked at home by 80 cents.” It’ll be even easier if you have your own timesheet tracker. Just take note of your total number of working hours and then do the math.

The best thing about this method is that everyone working remotely in your household can file at the same time. However, this shortcut also prevents you from claiming other WFH-related expenses, such as equipment costs or internet bills.

WFH Expenses Claims

If you think that the shortcut method can’t sufficiently cover all your expenses, there’s an alternative. Through this method, you can claim a rate of 52 cents per work hour. This can cover your work area’s maintenance costs such as cleaning, lighting, heating, and cooling.

Aside from maintenance costs, you can also include telephone and internet bills, stationery expenses, and even depreciation expenses for equipment. Simply list down all the work expenses you’ve accrued in the past year and then submit them for filing.

But if you’re more detail-oriented and meticulous about actual work-related expenses, the last option might be best for you.

Actual Work-Related Expenses Claims

Most of us dread listing down work expenses, but there are some who actually enjoy the process. Then again, there are benefits to such.

This third option allows taxpayers to claim actual work-related expenses, so long as you meticulously keep track of them. This can include your set-up maintenance, working hours, phone and internet bills, and other miscellaneous expenses. This is the most time-consuming method, but it does offer bigger benefits as well as the potential for larger expense claims, especially compared to the first two options.

Regardless of which option you choose, Loh reminded Australians to research and to always keep records.

Although it can be tempting to include all expenses you can think of when filing a claim, note that not everything will be accepted as such. For example, coffee or tea may help you stay awake or work better, but it doesn’t count as an expense because it’s not a requisite for earning an income.

You can claim large expenses, such as the cost of computers and laptops, but this can take time, particularly for items that cost more than $300. Thus, review the options presented above to figure out which one suits your needs best.

Working from home has its own benefits. It’s also obviously here to stay. If you’d like to stick to a remote working set-up but aren’t keen on bookkeeping or tracking expenses, you can get someone else to do it for you. And remotely at that.

Remote Staff has been bridging AU entrepreneurs and skilled Filipino remote workers for more than 13 years. If you need someone to take care of your bookkeeping, there’s probably already a good candidate waiting in our diverse talent pool.

Call us today or schedule a call back and let’s get started.

Serena has been working remotely and writing content for the better part of the last decade. To date, she's written for Pepper.ph and Mabuhay Magazine, among others, and has churned out more than a thousand articles on everything from The Basics of Stock Market Investing to How to Make Milk Tea-Flavored Taho at home. Hermits, aspiring hermits, and non-hermits with interesting project propositions may email her at serena.estrella10@gmail.com.

Zero Recruitment Fee

Zero Recruitment Fee