The story of Joanna Pascua, the Filipino worker whose legal battle with the Doessel Group has sent ripples through Australia’s offshore employment industry, is a tale with two sides—each deserving careful consideration.

At its heart, the case is not just about one woman’s fight for Filipino remote workers’ rights, but a mirror reflecting the complexities of a globalised workforce, the blurred lines of employment law, and the risks of cutting corners in the pursuit of cost savings.

The Pros: A Win for Worker Protections

Let’s start with the undeniable positives. Joanna Pascua’s victory before the Fair Work Commission (FWC) is being hailed as a landmark for offshore workers—especially those who, like her, were classified as “independent contractors” but worked regular hours, reported to supervisors, and used company systems just like any onshore employee.

The Fair Work Commission ruling sends a clear message: substance trumps form. If it walks, talks, and works like an employee, it probably is one.

For many, this is a long-overdue wake-up call. Too often, companies have shielded themselves behind the thin veil of “contracting” to avoid paying superannuation, leave, and other entitlements.

There’s nothing wrong with offshore workers seeking the benefits and protections they are due under fair work policies. In fact, it’s only right that those who contribute so much to Australian businesses—often for a fraction of the cost—are treated with dignity and fairness.

The Cons: Unintended Consequences and Unanswered Questions

But there’s another side to this story, and it’s not as clear-cut. The circumstances surrounding Pascua’s dismissal are, frankly, murky.

The Doessel Group accused her of unlawfully copying sensitive company and client information to her personal drive. If proven true, such allegations are serious and could have justified her dismissal on grounds of misconduct.

Yet, the FWC’s decision did not hinge on these claims, and the public is left wondering what really happened. The lack of clarity here is troubling, for both employers and employees.

Moreover, the ruling opens the door to potential exploitation—not just by Australian companies hiring overseas, but by workers as well. The ambiguity around employment status can be weaponised. Contractors who are unhappy with their arrangement might now be tempted to claim employee status retroactively, seeking entitlements after the fact. This legal uncertainty benefits no one in the long run.

Outsourcing Isn’t the Enemy—Illegitimacy Is

Let’s be honest: outsourcing is not new, nor is it inherently bad. In today’s tough economic climate, many Australian businesses simply cannot afford to hire locally for every role.

Offshore workers—particularly in countries like the Philippines—are a lifeline, keeping companies afloat and competitive. There is nothing shameful about this reality.

The real problem is not outsourcing, but illegitimacy.

When companies bypass legitimate agencies and opt for direct contracting, not to innovate but to dodge compliance and cut costs, they sow the seeds of future disaster. The short-term savings are illusory; as the Joanna Pascua case shows, the long-term risks—legal battles, reputational damage, and hefty payouts—are far greater.

Legitimacy as the Clear Workaround

The Pascua case underscores a crucial truth: legitimacy is the safest and smartest path for companies engaging offshore talent, regardless if it’s outsourcing vs EOR.

There is a vast ecosystem of legitimate outsourcing agencies and Employer of Record (EOR) Philippines service providers that exist precisely to mitigate the kinds of risks that ensnared the Doessel Group. For instance, there is Remote Staff EOR review to ensure legal compliance, particularly in labor law.

These organizations are not mere middlemen—they are offshore workforce compliance experts, deeply versed in local labor laws, tax regulations, and employee classification.

So what is an Employer of Record (EOR)?

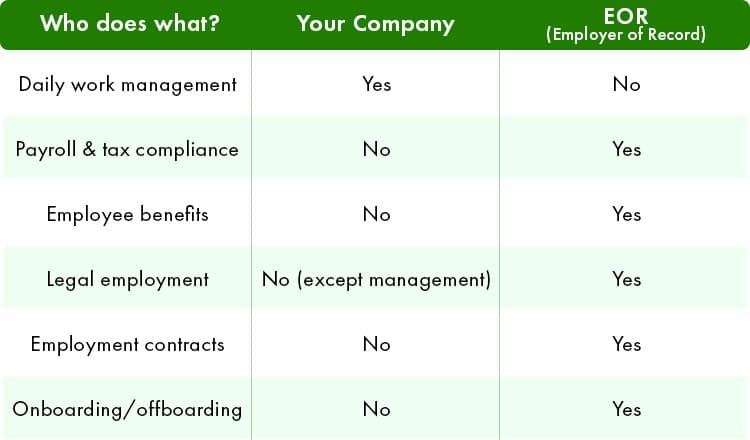

An Employer of Record (EOR) is a third-party company that officially employs workers on behalf of another business.

The EOR takes care of all the legal and administrative responsibilities of employment, such as payroll, taxes, benefits, and compliance with local labor laws, while the client company manages the employee’s day-to-day tasks and performance.

How Does an EOR Work?

- You Find the Employee

-

-

- Your company identifies and selects the person you want to hire, either domestically or in another country.

-

- EOR Becomes the Legal Employer

-

-

- Instead of hiring the employee directly, you contract with an EOR in the country or region where the employee will work.

- The EOR signs the employment contract with the worker and becomes the “employer on paper”, handling legal obligations of remote employers.

-

- EOR Handles Legal and Administrative Tasks

-

-

- The EOR manages:

- Payroll and tax withholding

- Employee benefits (health insurance, paid leave, etc.)

- Compliance with local employment laws

- Employment contracts and onboarding

- Termination and offboarding processes.

- The EOR manages:

-

- You Manage the Employee’s Work

-

-

- Your company still directs the employee’s daily work, sets goals, assigns projects, and evaluates performance.

- The employee works for you in practice, but the EOR takes care of the paperwork and remote staffing legal compliance.

-

- EOR Ensures Compliance

-

- The EOR keeps up with changing labor laws and regulations, reducing your risk of legal issues or fines, especially in foreign countries.

Simple Example

Imagine a US-based software company wants to hire a developer in Germany but doesn’t have a German office. Instead of setting up a German company (which is expensive and time-consuming), the US company partners with an EOR that already operates in Germany.

The EOR legally employs the developer, handles payroll and benefits according to German law, and ensures all taxes are paid. The developer works day-to-day for the US company, but all official employment matters are managed by the EOR.

Other Common Scenarios

- Testing New Markets: A company wants to try selling in a new country without a big investment. An EOR guides them on how to hire remote employees legally.

- Remote Work: An employee moves to another country. The EOR can employ them in their new location, so the company stays compliant with local laws.

- Hiring Remote Staff Legally: If a company wants to offer benefits to contractors or convert them to employees, an EOR can handle the transition and legal requirements.

- Mergers & Acquisitions: When acquiring a company in a new country, an EOR can temporarily employ staff during the transition.

EOR Benefits for Global Teams

- No need to set up a local entity in each country you hire in

- Faster hiring—onboard employees in days or weeks, not months

- Reduced risk—EORs manage offshore workforce compliance and legal issues

- Administrative relief—EORs handle payroll, benefits, and HR paperwork

Summary Table

In Short

An EOR lets you hire employees anywhere in the world, quickly and legally, without having to set up a local business.

You focus on the work; the EOR handles the legal and HR details.

If an Australian company hires a virtual assistant based in the Philippines through an EOR, is it possible for the employee to receive Australian benefits and be subject to Australian labor laws, instead of—or in addition to—receiving Philippine benefits and complying with Philippine labor laws?

You may ask: how can EORs protect Australian companies from legal or compliance issues or how do EOR prevents labor law issues? Here’s how:

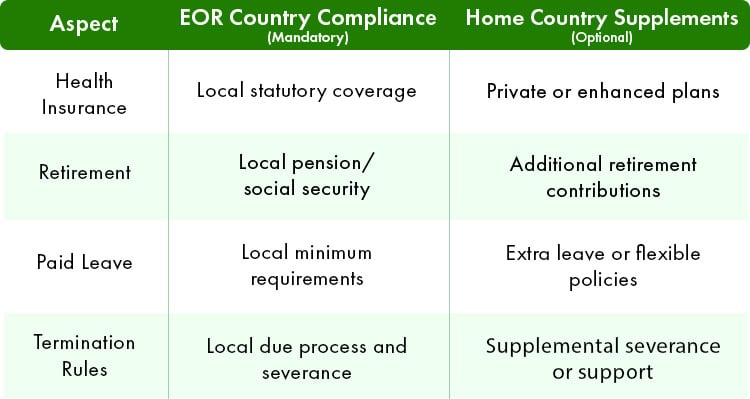

When a company from one country (the “home country”) hires an employee located in another country (the “EOR country”) using an Employer of Record (EOR), the EOR must comply with the labor laws and provide the mandatory benefits of the EOR country, since the employee’s physical location determines legal jurisdiction. In many cases, they also implement offshore employment best practices.

However, the home country company can choose to supplement these local requirements with additional benefits that reflect its own home country standards if desired.

Here’s how this works in general, regardless of which countries are involved:

- Primary Compliance: EOR Country Labor Laws

-

- The EOR acts as the legal employer in the employee’s country, ensuring global employment compliance with:

- Statutory benefits such as social security, health insurance, and any required local allowances.

- Payroll and tax withholding according to local regulations.

- The EOR acts as the legal employer in the employee’s country, ensuring global employment compliance with:

- Local employment terms, including contracts, leave entitlements, and termination procedures.

- Example: If a company in Country A hires a worker in Country B through an EOR, the worker will receive all benefits and protections required under Country B’s laws.

- Supplemental Home Country Benefits (Optional)

- While the EOR ensures compliance with local laws, the home country company can voluntarily offer extra benefits:

- Enhanced health insurance or retirement contributions.

- Performance bonuses or other perks that are common in the home country but not required in the EOR country.

- Flexible work policies or additional paid leave.

- Example: A company in Country A might offer private health insurance or extra vacation days to a worker in Country B, even if not required by Country B’s laws.

- Legal Limitations

-

- The laws of the EOR country always take precedence for employees physically working there.

- Minimum wage, statutory benefits, and local employment protections must meet the EOR country’s standards.

- The laws of the EOR country always take precedence for employees physically working there.

- Attempting to bypass or substitute these with home country laws is not permitted and could lead to remote hiring legal risks.

- Example: If Country B mandates a certain amount of paid leave, the company cannot provide less, even if Country A’s standard is lower.

- Key Differences in Benefits

- Practical Scenario

- If a company in Australia is hiring Filipino workers via an EOR, the EOR ensures compliance with Philippine labor laws (such as 13th-month salary and vacation pay).

The Australian company can add extra benefits, like private health insurance, but cannot replace Philippines legal requirements with Australian standards.

Summary

No matter which countries are involved, an EOR must comply with the labor laws and provide the mandatory benefits of the country where the employee is based.

The company from the home country can offer additional benefits, but cannot substitute its own labor laws or benefit standards for those of the EOR country

In the case of Joanna Pascua and Australia’s Offshore Workers could having gone through an EOR solved or mitigated the problem?

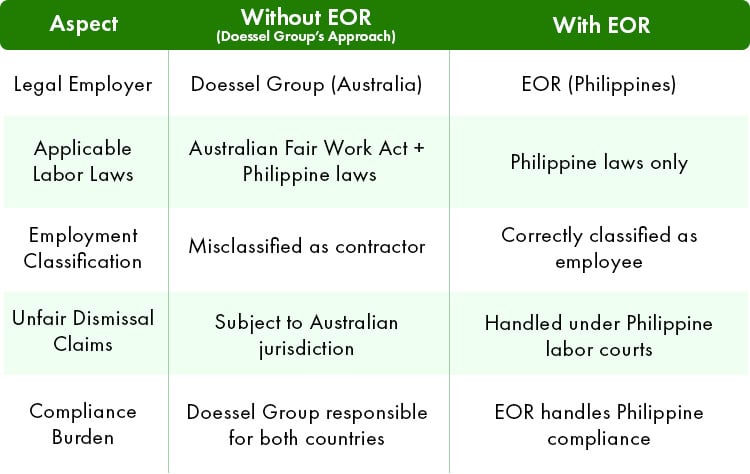

Using an Employer of Record (EOR) would likely have resolved the core issue in the Joanna Pascua v Doessel Group employment case. Here’s why:

1. Legal Employment Structure

- Problem in the Case: Doessel Group misclassified Joanna Pascua as an independent contractor despite her role functioning like an employee (fixed hours, supervision, use of company tools). This exposed them to Australian labor laws and penalties.

- EOR Solution: An Employer of Record service based in the Philippines would have legally employed Pascua locally, ensuring compliance with Philippine labor laws. This would have:

-

- Avoided ambiguity about her employment status.

- Shielded Doessel Group from Australian employment law obligations (e.g., unfair dismissal claims under the Fair Work Act).

2. Jurisdiction and Compliance

- Problem: The FWC ruled that Pascua was an employee under Australian law because the contract was formed via email in Australia, and her work was integral to the business.

- EOR Solution: With an EOR:

- Employment contracts would have been governed by Philippine law, not Australian law.

- The EOR would handle payroll, taxes, and benefits in the Philippines, reducing the risk of dual legal exposure.

3. Avoiding Employer Misclassification Risks

- Problem: Doessel Group’s contractor agreement failed to reflect the reality of Pascua’s employee-like role (e.g., supervision, fixed hours).

- EOR Solution: A reputable EOR would:

-

- Ensure proper remote employee classification (employee vs contractor) under local laws.

- Provide legal structure for remote employment contracts and work arrangements to align with Philippine labor standards, minimizing the risk of reclassification by courts.

4. Key Differences With vs. Without an EOR

5. Practical Outcome

Had Doessel Group used a Philippine EOR:

- Pascua would have been an employee of the EOR, not Doessel Group.

- Any termination or international employment disputes would fall under Philippine labor tribunals, not the FWC.

- The EOR would manage statutory benefits (SSS, PhilHealth) and ensure compliance with local minimum wage and leave policies.

Why This Works:

The Joanna Pascua case turned on the substance of the employment relationship, not just contractual labels. Thus, using EOR to avoid misclassification is essential, as it structures the employment relationship to reflect legal realities and helps prevent the pitfalls of misclassification.

As noted in the search results, Remote Staff’s Employer of Record services specializes in ensuring Australian labor law offshore workers are compliantly classified and managed.

*Exception: If Doessel Group had retained significant control over Pascua’s work (e.g., micromanaging daily tasks), even an EOR arrangement might face scrutiny. However, a properly implemented EOR model separates operational oversight (client’s role) from legal employment (EOR’s role), reducing this risk.

In short, using an EOR would have provided a clear legal framework to prevent the issues that led to Doessel Group’s liability.

The Way Forward

What’s needed now is clarity. Businesses must invest in proper structures—such as Employer of Record (EOR) arrangements—that ensure compliance with local laws and fair treatment for workers.

Governments should provide clearer guidelines for cross-border employment. And workers, for their part, should be honest about their status and responsibilities.

The Joanna Pascua case is a warning shot for offshore employment law in Australia. It’s a call for legitimacy, transparency, and fairness—on both sides of the employment relationship. Outsourcing will remain a vital part of our economy, but only if it is done right.

In the end, it’s not about where the work is done, but how it’s done. Legitimacy, not geography, is what truly matters.

Disclaimer: The views and opinions expressed in this article are those of the author and do not necessarily reflect the official policy or position of Remote Staff. The content is provided for informational purposes only and should not be construed as legal advice. Readers are encouraged to consult with qualified professionals regarding any legal or employment-related matters.

Syrine is studying law while working as a content writer. When she’s not writing or studying, she engages in tutoring, events planning, and social media browsing. In 2021, she published her book, Stellar Thoughts.