A growing number of employers are hiring remote professionals for various roles.

Many Australian firms, for example, outsource marketing, customer service, social media management, and other non-core functions, allowing their in-house teams to focus on core business tasks.

This mixed office setup often leaves many businesses unsure how to manage remote workers alongside in-house employees. As more Australians hire offshore talent, the line between “independent contractor” and “employee” becomes increasingly blurred – and that grey area could cost your business thousands.

Let’s take a closer look – and explore how an Employer of Record (EOR) can help you successfully navigate the legal complexities involved.

The Rise of Remote Work and the Legal Complexities It Brings

Managing employees can be challenging.

You need to handle contracts, payroll, insurance, and other benefits while also monitoring productivity and ensuring employee satisfaction. Global hiring isn’t all that different.

The Acceleration of Global Hiring

There’s been a great shift Down Under, wherein many employers are hiring remotely as part of their growth strategies.

This expansion fundamentally reshapes human resources. HR teams must now navigate complicated measures, such as:

- Labour Law – Employment contracts must comply with the labour laws of the employee’s home country.

- Tax Obligations – Companies must accurately calculate and withhold income tax and social security contributions in accordance with the laws of the employee’s country of residence.

- Currency and Payment – Processing payments in an employee’s local currency requires managing constant currency fluctuations and ensuring compliance with local banking regulations.

Why Legal Clarity Matters More Than Ever

Without proper guidance, global hiring significantly increases legal risks, often due to costly misclassification errors. This typically occurs when a business treats a worker as an independent contractor, even though local laws require them to be classified as an employee.

When this happens, businesses can face severe penalties, including back payments, fines, or interest, as tax and labour authorities actively scrutinise these arrangements to recover lost revenue and protect worker rights.

For example, in Australia, the Australian Taxation Office (ATO) and the Fair Work Ombudsman (FWO) actively enforce compliance. Penalties for serious violations of the Fair Work Act can reach as high as AUD $4.69 million.

Recently, the Joanna Pascua case made headlines. Although she was classified as an “independent contractor” by her Aussie employer, she worked regular hours and reported to supervisors. Thus, when she filed a complaint against her employer, the Fair Work Commission ruled in her favor, recognising her as a regular employee.

This is a landmark case reflecting the complexities of a globalised workforce – and the blurred lines of employment law and how cutting corners can cost you.

The Legal Grey Zones Every Australian Employer Should Know

To avoid another Joanna Pascua controversy, here are some legal matters and grey areas every Australian employer should be aware of:

Misclassification: When Contractors Are Actually Employees

In Australia, if a worker is employed by a business and operates under the employer’s direction and control, they are entitled to statutory rights such as fair pay, paid leave, and protection against unfair dismissal and discrimination.

Conversely, contractors are considered independent from the business if they have control over how and when they perform their work.

While this may seem straightforward, the line often blurs when businesses exercise full control over a worker’s tasks and performance yet still classify them as independent contractors.

Thus, the FWO and the ATO use the “Whole Relationship Test” to determine a worker’s true employment status, as demonstrated in Pascua’s case. This test transcends the written contract and considers factors such as the employer’s level of control, financial risk, ability to delegate tasks, and the expectation of ongoing work.

Consequently, misclassifying an employee as a contractor is illegal under Australian law and can lead to serious financial and legal consequences.

Tax Residency Complications

Tax considerations add another layer of complexity.

While taxes are already complicated on their own, hiring an employee directly from another country makes them even more challenging. This setup can easily trigger dual tax residency for remote workers, while the company must also account for corresponding tax liabilities in its own country of operation.

Generally, an Australian company is not required to withhold Pay-As-You-Go (PAYG) tax, pay the Superannuation Guarantee (SG), or remit payroll tax in Australia if the contractor performs all services outside the country.

However, legal risks arise when the full-time nature of the arrangement causes a remote worker to be classified as an employee under the Whole Relationship Test.

In such cases, Australian government agencies may require the employer to comply with the applicable tax obligations mentioned above. Failure to do so could result in compliance violations or legal penalties.

Compliance Pitfalls in Cross-Border Hiring

Ignorance of the law is not a defence for employers in any jurisdiction.

Similarly, the Australian government penalizes businesses that fail to meet statutory requirements, particularly those related to tax and labour laws.

This complex web of regulations often discourages employers from directly hiring remote workers. The sheer volume of additional tasks can be overwhelming, particularly when managing the day-to-day demands of running a business.

To overcome these challenges while still enjoying the benefits of remote work, savvy businesses turn to outsourcing – or, better yet, partner with an EOR. This strategy allows them to hire globally without managing legal complexities or risking non-compliance.

How Employer of Record (EOR) Services Solve These Legal Challenges

Remote work is a win-win for both employers and employees. Employers gain access to skilled professionals at competitive rates, while workers can earn competitive salaries from working for international companies without leaving their homes.

However, like any work arrangement, remote work comes with its challenges. In global hiring, a key issue is legal compliance, as grey areas often require expert guidance to navigate.

This is where an EOR can help.

What Is an Employer of Record (EOR?)

An Employer of Record (EOR) is a third-party service that acts as the legal employer for a company’s staff in a specific country. This allows you to hire employees on your behalf, enabling access to global talent without the need to establish a branch or subsidiary abroad.

As the legal employer, the EOR takes on all the administrative and legal burdens associated with employment. This includes:

- Ensuring compliance with complex labour laws;

- Drafting legally sound remote employment contracts;

- Running compliant multi-currency payroll; and

- Calculating and remitting taxes and social contributions.

With this model, companies retain day-to-day control over employees’ work, performance, and tasks, while the EOR handles all legal responsibilities and administrative paperwork. Crucially, this setup also minimises the risk of employment misclassification.

Compliance Without the Red Tape

An EOR ensures companies like yours can comply with the legal requirements without the administrative burdens of setting up legal entities in other countries. Thus, they take care of:

- Legal Documentation – They draft and execute employment contracts that include all mandatory provisions on probation, notice periods, and statutory leave, reducing the risk of future legal disputes.

- Tax Filings and Contributions – They also handle all mandatory withholdings, including the remote employee’s income tax and the employer’s share of social contributions (pension, insurance, and healthcare). They then process payments and file all required reports on your behalf.

- Employee Benefits – They manage statutory benefits to ensure compliance with local requirements for healthcare and paid time off. This ensures that all employees receive the full entitlements mandated by their country’s laws.

Reducing Risk Through Local Expertise

Instead of setting up a branch or subsidiary, it’s more practical and cost-effective to partner with an EOR that can handle all the legal and financial risks of hiring overseas.

Their local expertise in laws and regulations also helps ensure full compliance with statutory requirements.

For example, an EOR like Remote Staff has a dedicated network in the Philippines that provides on-the-ground legal support. This means they have in-depth knowledge of Philippine labour laws, tax regulations, and social security requirements for your Filipino remote workers.

Real-World Scenarios: How EORs Solve Compliance Problems

Here are some examples of how Employers of Record can help your business.

Case Study #1: The Misclassified Remote Marketer

Many small and medium-sized businesses (SMBs) hire remote workers for non-core functions. For instance, if you’re a Sydney-based SMB, you can directly hire a content marketer from the Philippines.

To keep things simple and cost-effective, you classified your remote worker as an independent contractor and stated this clearly in the contract. The agreement also outlined basic job details such as fixed working hours, direct reporting, and the use of company-issued software.

The Compliance Problem

If this working relationship is audited, your company could face legal issues because, under the Whole Relationship Test, the “independent contractor” would actually be considered an employee under Australian law.

The EOR Solution

By partnering with an Employer of Record instead of hiring directly, you can eliminate the risk of worker misclassification. The EOR will legally employ the content marketer on your behalf and will:

- Draft a fully compliant local employment contract;

- Calculate and remit all mandatory taxes and social contributions in the Philippines; and

- Manage the required statutory leave and benefits.

Case Study #2: The Dual Tax Dilemma

On another note, suppose you’re a tech company looking to hire a highly skilled software developer. However, the developer works remotely from the Philippines for half the year and spends the rest of the time in Australia.

The Compliance Problem

The developer’s situation creates a dual tax residency issue, as he meets the residency criteria for both the Australian Taxation Office and the Philippine Bureau of Internal Revenue (BIR) for tax purposes.

As his direct employer, you would then face conflicting tax obligations, including:

- Australian Payroll – When the developer works in Australia, you must withhold PAYG tax and remit Superannuation Guarantee contributions as required.

- Philippine Payroll – However, when he works in the Philippines, his income for that period may be subject to Philippine income tax, and you might need to register with the BIR to comply with local withholding requirements.

- Double Taxation – Additionally, the employee risks being taxed on the same income in both countries if the AU-Philippine Double Taxation Agreement (DTA) tie-breaker rules are not correctly applied.

The EOR Solution

Fortunately, you can still hire the skilled software developer without the hassle or stress by using an EOR, which will handle:

- Correct Withholding and Registration – The EOR will register the developer in the Philippines and ensure correct withholding according to local income tax rates while he is working there. They will also handle all mandatory Philippine social security contributions.

- DTA Application – The EOR’s tax experts will structure the employment to correctly apply the DTA, ensuring the developer avoids improper double taxation. In short, the EOR manages compliance between the two tax systems.

With this approach, the developer receives a single, compliant pay slip for all work, regardless of location. More importantly, your company stays compliant with both the ATO and BIR without needing to set up a costly, complex HR and tax entity in two countries.

#3. Case Study 3: Cross-Border Contracting Made Simple

Say you’re a fast-growing digital marketing agency in Brisbane that just secured a major international client, requiring you to quickly and compliantly hire three skilled marketing professionals — a graphic designer, a copywriter, and a video editor — each based in a different country.

The Compliance Problem

It’s back-breaking, not to mention financially draining, to set up legal entities in three different countries just to stay compliant with labour and tax laws.

And even if you somehow had the time and energy, dealing with three separate systems for payroll taxes and social contributions is rarely worth the stress. To make things worse, you’d still need to prepare three different employment contracts, each compliant with local rules on minimum wage, mandatory leave, and termination procedures.

The EOR Solution

An experienced EOR can take all these tasks off your plate. You can rely on them to:

- Draft all employment contracts and ensure immediate compliance with local laws;

- Handle the entire payroll cycle, including proper withholding and tax remittance;

- Administer local employee benefits and manage mandatory annual leaves.

This way, your agency avoids the cost, time, and risk of setting up three foreign subsidiaries just to hire the talent you need.

More importantly, you can onboard all employees within a week or two, allowing you to focus entirely on their output while the EOR handles 100% of the compliance requirements across all borders.

Why Australian Businesses Shouldn’t Ignore the Legal Grey Zone

Business and legal matters always go hand in hand.

Whether you like it or not, you must understand and comply with various laws and regulations to keep your business running smoothly. While this can be complicated, it doesn’t have to be difficult, especially when you have an EOR supporting you.

Financial and Legal Risks

Employee misclassification can happen even if it’s unintentional. But this mistake can be costly, especially in cross-border remote arrangements – as seen in the Joanna Pascua case.

Such a mistake can lead to serious financial and legal risks, not to mention reputational damage, which is often even more costly in the long run.

That’s why legal compliance should be a non-negotiable part of your global hiring strategy. And if you don’t have the time or expertise to manage it properly, it’s best to partner with an EOR.

Brand Reputation and Trust

Customers, investors, and potential partners often see companies with compliance breaches as unethical and unreliable.

This is even more true today, in an era of backlash and #cancelculture, where a company can be “cancelled” not only for its products but also for how it treats its employees.

Existing employees may also lose trust in the company if they see a colleague exploited or subjected to non-compliant arrangements, leading to lower morale, reduced productivity, and ultimately, higher turnover.

Opportunity Cost of Non-Compliance

SMBs might hesitate to partner with an EOR because of the upfront cost. But the fines and legal fees from cross-border compliance mistakes can end up being far more expensive.

When an Australian company faces an audit, the cost goes beyond legal fees and penalties.

Senior leaders, including the CEO and managers, may spend countless hours – or even months – responding to government inquiries, coordinating with lawyers, and calculating back-pay liabilities.

This diverts attention from core business activities like product development, sales strategy, and market expansion, leading to stalled growth and a loss of competitive advantage. Ongoing compliance issues also create stress and distraction across the organisation, lowering morale, productivity, and innovation.

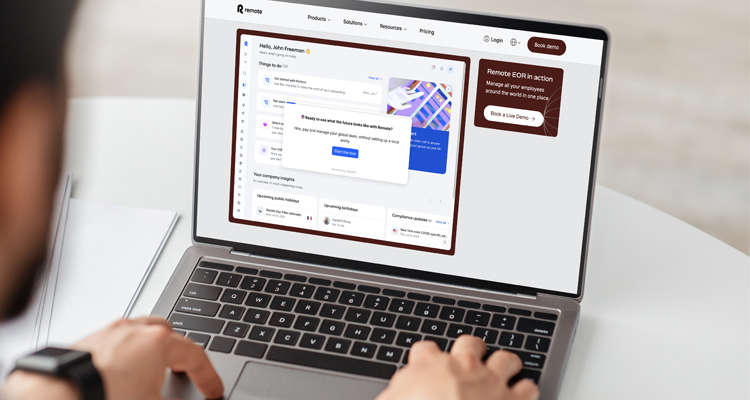

How Remote Staff Helps You Stay Legally Compliant

For the last 17 years and counting, Remote Staff has helped over 3,000 Australian businesses legally hire skilled Filipino professionals – hassle-free.

Remote Staff serves as the legal employer for your Philippine-based remote workers, handling HR management, compliance monitoring, and payroll and tax obligations.

This setup allows you to retain full control over their tasks and performance, while Remote Staff takes care of all administrative and compliance responsibilities, reducing the risk of misclassification and tax issues.

Frequently Asked Questions (FAQs)

Here are some frequently asked questions about EORs and the services they provide.

#1: What’s the Difference Between An EOR and a Recruitment Agency?

A recruitment agency focuses on sourcing and vetting talent to fill open positions. Once a candidate is hired, the agency’s role ends, and the client assumes all employer responsibilities.

In contrast, an EOR like Remote Staff not only sources and vets talent but also legally employs the chosen candidate on the client’s behalf.

They handle payroll, tax filings, benefits, and all local labour compliance, while the client focuses solely on managing the employee’s day-to-day work.

#2. Can An EOR Protect Me From Tax Misclassification?

Yes. The EOR framework is specifically designed to protect companies from the significant risks of tax and employment misclassification when hiring internationally.

Since the EOR is the legal employer, they issue the required local employment contract and ensure the worker receives all statutory benefits. They also take responsibility for all mandatory local payroll and tax obligations.

#3. How Much Does An EOR Service Cost?

EOR service fees typically range from AUD $350 to $800 per employee per month, though costs may vary depending on the complexity of services provided.

On average, EOR providers have two pricing models:

- Flat Monthly Fee – A fixed monthly fee per employee, regardless of their salary; and

- Percentage of Payroll – The fee is calculated as a percentage of the employee’s gross monthly salary.

#4. Is It Legal to Hire Full-Time Remote Workers Overseas Under An EOR?

Yes. The EOR model addresses two major legal challenges in international hiring: setting up a local entity and ensuring employment compliance.

Legally, the EOR is the official employer, responsible for meeting all government employment requirements. Additionally, the EOR maintains a registered legal entity in the employee’s country, ensuring the arrangement is fully compliant and shielding your Australian company from liability.

Conclusion: Stay Compliant, Stay Competitive

Remote work is here to stay, and so is global hiring.

The business landscape has gone beyond borders, and to stay competitive, SMBs need to build a global workforce of skilled professionals from diverse backgrounds.

However, this is easier said than done. With overlapping time zones and varying jurisdictions, it’s easy to get lost in the legal complexities. But with an Employer of Record, remote hiring can be safe and hassle-free.

With the right EOR, businesses in Australia no longer have to worry about legal grey areas. By letting EORs like Remote Staff handle the legal responsibilities, Aussie SMBs can compete, scale, and grow their business – legally and ethically.

So, what are you waiting for? Call us today or request a call back now.

Syrine is studying law while working as a content writer. When she’s not writing or studying, she engages in tutoring, events planning, and social media browsing. In 2021, she published her book, Stellar Thoughts.