Accounting in business is like painting a true picture of how your business is doing. You need this picture to be accurate so you can report, plan and scale your business correctly.

Shouldn’t accounting be private? Yes, but it’s not ideal that you do it all by yourself.

Without proper accounting, your strategic plans for your business will stand on a weak foundation. To know your “books” – your profit, your losses, your product inventory, and your expenses – is an essential part of your decision-making process.

Table of Contents

-

-

-

- How much do virtual accounting services usually cost?

- How do I decide which of the outsourcing accounting services available is fit for my business?

- Which of the following accounting software is best for my business?

- What are the benefits of hiring a virtual accountant?

- The Characteristics of a Good Virtual Accountant

- Partner with Remote Staff

- How do I know if I need a bookkeeper or an accountant?

-

-

How much do virtual accounting services usually cost?

Gone are the days that people keep a manual ledger. And if you’re still doing this “pen and paper style” by yourself – you’re missing on a lot of manpower hours that you could spend on your passion, your business, and your time with friends and family.

Depending on the subscription plan you choose, you can have an online accounting software plan for as low as 10 AUD. Also, some virtual assistants (depending on whether you need a bookkeeper or an accountant or any specialized skill) start at 7 AUD per hour.

How do I decide which of the outsourcing accounting services available is fit for my business?

Before you make a decision, there are factors you need to consider:

1. Outline the Features and their Benefits

Firstly, what features or functions are most important for your business at the moment?

You should be able to name at least three. For example, if all you need is tracking your income and expenses, then spreadsheets and other free budget and expense trackers are the best solutions for you. However, if you’re a small business with at least one employee, then, you would want to look into online accounting software that can support payroll for your current and future state.

Next, are there features that you only need temporarily? You wouldn’t want to get a package or a subscription plan which features you don’t need but is tucked in the price.

2. Consider Your Business’s Need

Is your business under sole proprietorship? Do you keep an inventory of physical goods? Is multi-currency functionality important to you? Do you accept payments from your customers through payment gateways like Paypal, Square, or Stripe?

Choose the online accounting software that can support your front liners and your customers well.

Also, determine whether a particular feature can be added later on, to avoid being locked in a period where these features are part of your bill but not being fully utilised.

3. Always Check the “True” Price

Online accounting software plans will always position a discounted price when you sign up. Ask yourself, “What will my business look like tied to this plan when the discount, promo, or trial period is over?”

You wouldn’t want to pay more for either upgrading or terminating a plan early. Dissect the way a particular plan or package is priced. Only then you would understand if the benefits outweigh the cost.

4. Research on the Scope of the After Sales Support

The type of support you get after purchasing a plan is critical to overcoming the issues that arise when you’re already using the product.

You need to check reviews online. Get answers to these questions:

- Are they known to solve issues with a quick turnaround time?

- How well do they communicate?

- Are they available during your operating hours?

- Is there a number to call or can they only be reached via chat or email?

Knowing who to contact and how fast a product’s support process is crucial especially when your people and your numbers are impacted by the technical issues you might encounter.

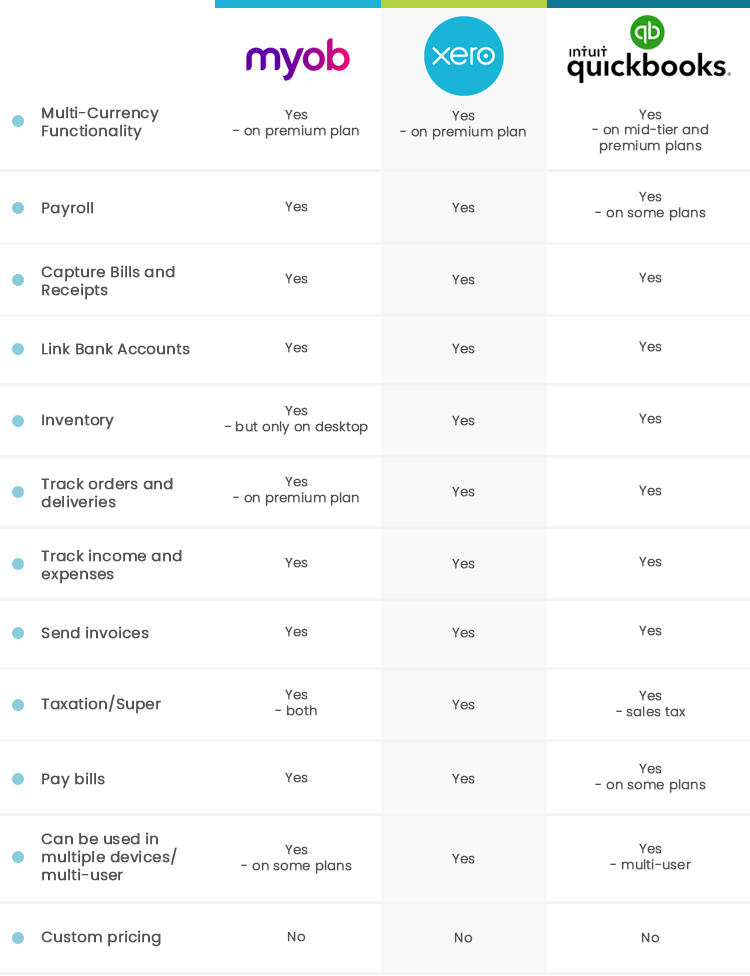

Which of the following accounting software is best for my business?

It all depends on what your business is about and how you tell your story to a specific audience.

Take a look at this example below of the top 3 accounting software for small businesses in Australia:

Disclaimer: The prices and features can change anytime without prior notice. The opinions stated here are the writer’s own and not that of RemoteStaff. We encourage you to check their individual websites before you decide.

Disclaimer: The prices and features can change anytime without prior notice. The opinions stated here are the writer’s own and not that of RemoteStaff. We encourage you to check their individual websites before you decide.

After looking at the features side-by-side, let’s take a look at the price for each:

Mind Your Own Business (MYOB) software plans are divided into two categories – the Essentials, which will work with Windows and Mac and AccountRight, which will work on Windows only. What’s unique with MYOB is that calculating and tracking GST is embedded in the plans. No need to add it or change the settings.

Xero, on the other hand, is known for its clean look and API, which is software where applications can talk to each other. So let’s say you have products on an e-commerce site and you want to reconcile the payments you receive from Stripe/Paypal to reflect on what’s left in your inventory then Xero may be the one for you.

QBO also does have the same feature as Xero and MYOB. Some steps might be longer but it does have some powerful features like how their bank connections and reconciliations look like. They also stand out also because of the plan that’s made for Self-employed expenses only.

Here is a comparison of their price plan’s side-by-side:

Disclaimer: The information posted was taken from the brand’s individual site. Some run promos and trial periods that may affect pricing. Please check their terms and conditions separately.

There are other players in the field like Wave, Zoho, Freshbooks, budget and expense trackers, and free spreadsheet templates.

Outsourcing your accounting services doesn’t mean that you won’t be involved in tracking your business’ financial records. It just means that you’re leveraging the tools and expertise available to get the most out of managing your finances.

What are the benefits of hiring a virtual accountant?

Here are some of the benefits of outsourcing your accounting tasks to a trusted virtual accountant:

1. Save time

Tracking and keeping records, balancing sheets, and analysing will take time and effort. When you outsource this task to a professional virtual bookkeeper or accountant, the work will be finished faster and you’ll have more time to do what you’re good at – your business.

2. Get prompt and professional advice

With a virtual accountant working with you, you have someone to interpret the data and organize the reports for you. You have someone to watch for the potential pitfalls versus what the numbers can only show you.

3. Improve efficiency

A virtual accountant can assist you in preparing your financial statements, manage your cash flow, and make sure your business is compliant with laws and regulations that are related to your business.

The Characteristics of a Good Virtual Accountant

The best virtual accountants are highly organized, have strong attention to detail and technical knowledge of the specific tasks you want them to manage in your business’s financial statements.

They work well independently, but also within a team. They have excellent time management skills and work effectively under pressure and are comfortable even with tight deadlines. They don’t get easily distracted and have laser-focus dedication to complete the tasks error-free.

Partner with Remote Staff

There is still a limitation to what you can expect as an output from the system. Accounting software can provide you neat and easy access to your dashboard, but only a person can help you create a financial forecast and assist you with other administrative tasks.

How do I know if I need a bookkeeper or an accountant?

A bookkeeper records your transactions, assists with creating, and summarizing reports. On the other hand, an accountant can also do bookkeeping tasks plus analyse your records.

Give us a call or schedule a callback so we can help you find your virtual accountant with background, knowledge, and expertise in MYOB, Xero, and Quickbooks (QBO).

Whether it’s internal, financial, or tax accounting – the best-outsourced accounting service will still be a virtual accountant with the expertise to utilise the online accounting software and recommend data-based action plans.

You get the benefits of technology and work with an industrious person who knows what to do and cares about what you do.

Zero Recruitment Fee

Zero Recruitment Fee